|

|

| IPRS | Research | Services | Education | Health | Contact Us | Sponsors | External Links | |

Innovative Products Research & Services, Inc.

a 501(c)(3) non profit organization chartered in Massachusetts

Putting Creativity to Good Use

Environmental Solutions

Carbon Credits

Historically there have been a number of approaches to influence desired environmental outcomes (and to pay for associated services. In recent years, the concept of giving Carbon Credits to manufacturers who were producing more eco-friendly products was developed. This policy has had mixed results and may have some drawbacks as explained further in the white paper below developed by an IPRS volunteer Ritika Sowda.

Carbon Trading in the Automotive Industry

By Ritika Sowda

With climate change becoming an increasingly severe threat, many countries are attempting to shape their economies to become less carbon intensive. Two major ways of approaching the emissions issue would be to either tax the carbon that is emitted by the pollutants OR to create an emissions trading system (“ETS”). Carbon taxation has the ethical benefit of the “polluter pays” approach which incentivizes the industry to invest in research and development (“R&D”), thereby allowing us to see an effective reduction of emissions generated at source. The ETS, on the other hand, essentially creates a market for carbon emissions where companies that have lower emissions have the right to sell their extra regulatory credits to larger emitters.

Both reduction tools, i.e., carbon taxation and ETS, heavily rely on the economics of supply and demand. To emphasize, the carbon taxation approach aims at reducing emissions by setting a pre-determined price that would freely set the total quantity of emissions generated. The ETS works in the opposite manner, i.e., it sets the market cap on the total quantity of emissions that can be generated which then freely establishes the market price for the emissions. Some opine that the benefit of the ETS lies in establishing the total quantity of emissions which can be considered useful for further planning and research. Others believe that this mechanism enables polluters to continue emitting at high levels without having to face the full consequences of their actions. The simple ability to trade the ownership of carbon may not incentivize manufacturers enough to develop newer and more efficient technologies.

One point to be noted about carbon taxation is that it works more effectively in markets that have high demand elasticity. It would not be feasible to implement carbon taxation policies in inelastic markets where high switching costs prohibit significant reduction in the quantity of emissions. This makes it clear that both mechanisms carry their own share of benefits and drawbacks which countries need to analyze before applying either or both approaches to their economic sectors.

The transportation sector, in particular, significantly contributes to global emissions. For the purposes of the study, we have put more focus on the road transportation sector which emits 11.9% of the total greenhouse gas emissions (“GHGs”) across all sectors and 45.1% of GHGs in the transportation sector. It has been observed that the industry is relatively inelastic which makes the application of carbon taxation quite tricky. This may be one of the reasons why carbon credit trading is more prevalent in the transportation industry, particularly, in the road transportation market.

There are presently two major ways through which auto manufacturers can achieve lower emissions.

• One way is to invest in research and development (“R&D”) to develop new technologies for petrol/diesel cars or vans such as combustion engines, turbochargers, etc.

• The second approach would be for manufacturers to introduce electric vehicles (“EVs”) in their car fleets.

The exhibits below give a brief overview of the current status of fuel efficiency relevant to the above-mentioned approaches:

• Cars and Vans

|

Fuel efficiency in 2017 |

7.2 Lge/100 km1 |

|

Fuel efficiency to be achieved by 2030 |

4.4 Lge/100 km |

|

Average annual growth required to achieve the target |

3.7% |

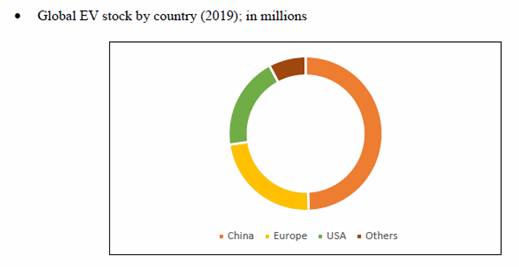

• EVs

|

Global EV stock in 2019 |

1% of total fleet |

|

Global EV stock to be achieved by 2030 |

13% of total fleet |

|

Average annual growth required to achieve the target |

36% |

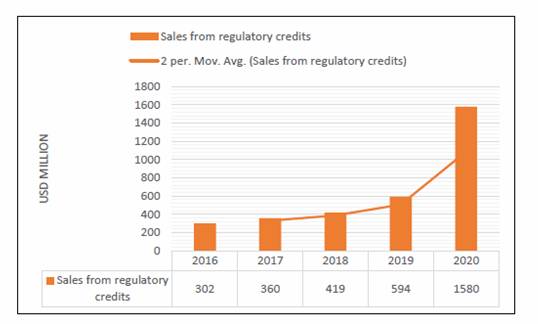

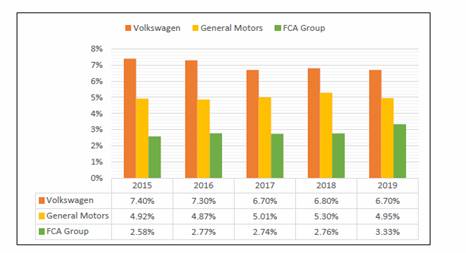

On the other side of the transaction, we have auto manufacturers such as Volkswagen, Fiat Chrysler and General Motors which have been known to purchase carbon credits from Tesla to meet compliance requirements. Essentially, local governments mandate that auto manufacturers have a certain amount of carbon credits each year. As discussed earlier, manufacturers may do this by producing a certain amount of zero emission vehicles annually or by developing their R&D capabilities. However, when they are unable to meet these regulatory requirements, they have the option to purchase the excess credits that another manufacturer is willing to sell. In this particular case, we can see that Tesla’s revenue from regulatory credits is witnessing significant growth and it is material enough to be reported as a separate segment in Tesla’s financial statements. This can be viewed as a sign that the emission trading system is not functioning in the way it was meant to. Ideally, we should be able to witness an increase in R&D expenditures across the industry, but we are not able to see that in this particular case. The exhibit below displays the R&D/Sales ratios reported by auto manufacturers that have been known to buy huge amounts of carbon credits from other manufacturers.

Across all three manufacturers, there has not been considerable growth in R&D investment in the period from 2015 to 2019. If this data was to be parallelly compared with the previous exhibit, it becomes somewhat evident that buying regulatory credits is the preferred substitute to ambitiously investing in low emission technologies.

In conclusion, as carbon trading or offsetting can often be misused, certain policy interventions may be required to further incentivize bolder action from auto manufacturers. The key lies in holding the polluter accountable for their actions which is an important feature of the carbon taxation model. To induce more demand elasticity in the transportation industry, policy makers may focus on improving accessibility to public transport or spending on infrastructure. Alternatively, the ETS could potentially be modified by putting a cap on tradable credits. Given the urgency of climate change, we need to see this issue beyond the monetary costs associated with driving solutions and lead the way by actively engaging in ambitious sustainability strategies.

References:

1) Global Change Data Lab, “Sector by sector: Where do global greenhouse gas emissions come from?”,https://ourworldindata.org/ghg-emissions-by-sector.

2) Statista, “Distribution of carbon dioxide emissions produced by the transportation sector worldwide in 2018”, https://www.statista.com/statistics/1185535/transport-carbon-dioxide-emissions-breakdown/.

3) International Energy Agency (IEA), “Tracking Transport 2020”, https://www.iea.org/reports/tracking-transport-2020.

4) CNBC, “Tesla’s sale of environmental credits help drive to profitability”, https://www.cnbc.com/2020/07/23/teslas-sale-of-environmental-credits-help-drive-to-profitability.html.

5) Reuters, “Volkswagen to buy credits from Tesla in China to comply with environmental rules – sources”, https://www.reuters.com/article/uk-volkswagen-tesla-china-exclusive-idUKKBN2BO588

6) Annual Reports.com, Tesla Inc. Annual Reports (FY18-FY20), https://www.annualreports.com/Company/tesla-motors.

7) Annual Reports, General Motors (FY16 -FY19), https://www.annualreports.com/Company/general-motors

8) Volkswagen AG website, Annual Reports (FY19), https://www.volkswagenag.com/en/InvestorRelations/newsandpublications/Annual_Reports.html

9) Fiat Chrysler Automobiles (FCA) website, Annual Reports (FY17 - FY19), https://www.fcagroup.com/en-US/media_center/publications/Pages/annual_reports.aspx

---End of White Paper --

Return to:

Environmental Solutions Overview

Role of Government

Transportation Sector

EV Economic Analysis

© 2021- 2024, All Rights Reserved, IPRS Inc.

Revised:

February 16, 2024